The State of Insurance for Trucking Companies:

How To Get Better Commercial Truck Insurance Rates

Part Two of a Two-Part Series

Commercial truck insurance is one of the top 3 largest expenses for all trucking companies – whether they are seasoned or startups. Don’t have it? Well, you don’t run legally. Period.

But there is a lot of misinformation regarding commercial truck insurance, especially when it comes to planning and pricing. We talked with trucking insurance experts John Mondics, President, and Jonathan Mondics, Vice President, of Plano, Texas-based Mondics Insurance Group, for a two-part series answering top-of-mind questions about factors that affect commercial truck insurance rates.

Part one focused on the planning stage to getting a quote and securing insurance. Now we explore pricing and the reasons why trucking insurance costs have increased significantly.

What’s happening with trucking insurance costs?

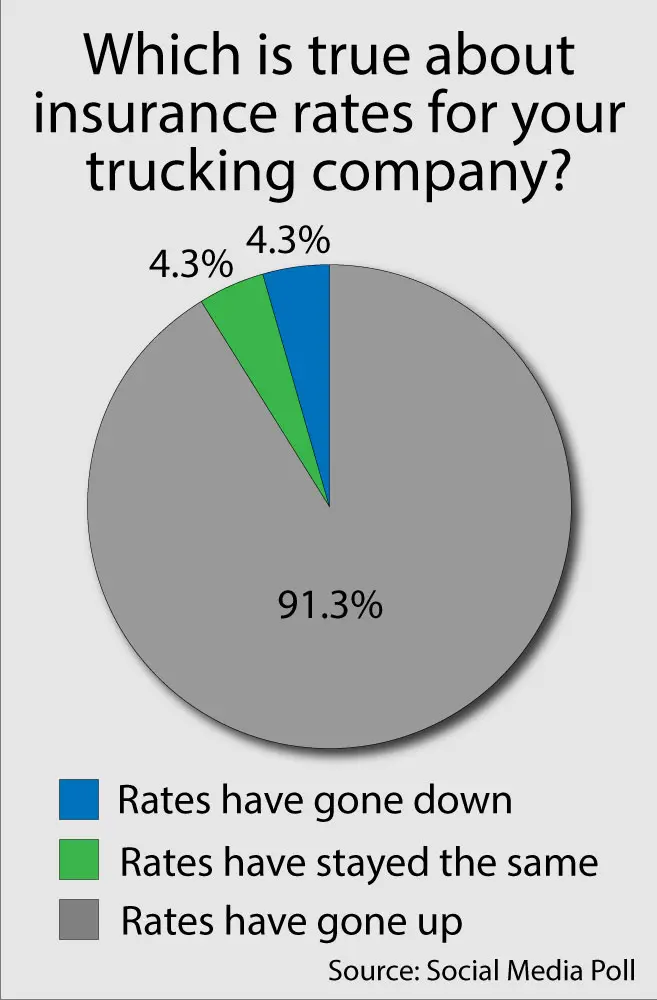

“Trucking insurance costs are increasing at more than double-digit rates,” says John. “The trucking insurance marketplace has been operating at a loss for the last five years. The operating loss ratio is 112%. What that amounts to is this: They are operating at a negative loss ratio, so the rates have to go up.”

John continues, explaining why costs are escalating: “The reasons are the jury awards that we all read about. But in addition to that, the everyday clients. You used to be able to settle a minor bodily injury claim for $35,000-$40,000. Today that’s running maybe four to five times that amount. The cost to repair trucks and automobiles today is much higher than it was 3 years ago. A small claim is now $8,000-$10,000. Some insurance companies are withdrawing from the marketplace because they don’t feel they can charge enough to cover the coverage.”

What is the average cost of commercial truck insurance?

Ah, this is the big question. But, as you would expect, it doesn’t have an easy answer.

“There are so many variables – age of equipment, what you are hauling, location, size of your company,” says Jonathan. “Even if you have two identical companies hauling the same thing and one has lousy drivers with a DUI or a million-dollar policy claim, he could be paying $35,000 per truck per year.”

John gets right to the point: “There really is no average,” he says. “It’s really all about who, what, where. If you are delivering dairy on a rural road, you are going to pay substantially less than somebody delivering heavy equipment in Houston. It’s not only where you’re based but where you haul to. A clean driver may drive for $8,000 per truck per year, but one with many accidents and tickets may be paying four times that amount. Loss experience is a factor, and the driver profile is a factor.”

In Part One we talked about the importance of CSA scores, which come from the Federal Motor Carrier Safety Administration (FMCSA) and offer detailed motor carrier history data that can prove very informative for insurance companies when making underwriting decisions.

Also, as mentioned above, where you are based and where you are hauling has a lot to do with how much insurance you pay.

Here’s a quick list of high trucking insurance rate states:

- Florida (especially Miami and Fort Lauderdale)

- New Jersey

- New York (although upstate is not as bad)

- California (not the entire state, though)

- Texas (same as California)

- Louisiana

And then on the opposite end of the spectrum are states with the lowest commercial truck insurance:

- Kansas

- Oklahoma

- Texas (parts of the state)

- Alabama

- Georgia

What can carriers do to save on insurance?

Jonathan immediately responds with driver selection: “Before you hire a driver, check their motor vehicle record (MVR),” he says. “If you have a lot of driver turnover, if insurance companies see that you jump ship midterm after midterm, or you change insurance companies every quarter, you are not going to get the best pricing. Underwriters want to see partnership, loyalty. They don’t want to get burned.”

John agrees and offers more on the importance of driver selection: “You need the guy that has the experience,” he says. “The higher, better-quality driver you have and the better-quality equipment you have will save you money in the long run. If you can prevent losses, you will be a desirable risk. If you have a poorly maintained vehicle and you are a bad driver, you are going to pay more on insurance. If you have a well-maintained vehicle and you have a good driving record, you are going to pay a lot less on insurance.”

The bottom line when it comes to trucking insurance is that insurance companies do not want to insure instability. They always want to insure stability.

At Apex, we want to help trucking companies become stable so that they can grow successfully. We know that steady cash flow is the key to growing a successful trucking company. Let us buy your freight invoices and you can get paid in as little as a few hours. Visit our website or give us a call at 855-369-2739.